Oil hits five-month high after US strikes key Iranian nuclear sites

Source: USA Today/Reuters

Updated June 22, 2025, 8:54 p.m. ET

SINGAPORE - Oil prices jumped on Monday, local time, to their highest since January as Washington's weekend move to join Israel in attacking Iran's nuclear facilities stoked supply worries.

Brent crude futures rose $1.88 or 2.44% at $78.89 a barrel as of 1122 GMT. U.S. West Texas Intermediate crude advanced $1.87 or 2.53% at $75.71.

Both contracts jumped by more than 3% earlier in the session to $81.40 and $78.40, respectively, five-month highs, before giving up some gains.

The rise in prices came after President Donald Trump said he had "obliterated" Iran's main nuclear sites in strikes over the weekend, joining an Israeli assault in an escalation of conflict in the Middle East as Tehran vowed to defend itself. Iran is OPEC's third-largest crude producer.

Read more: https://www.usatoday.com/story/money/markets/2025/06/22/oil-prices-after-us-hits-iranian-nuclear-sites/84311507007/

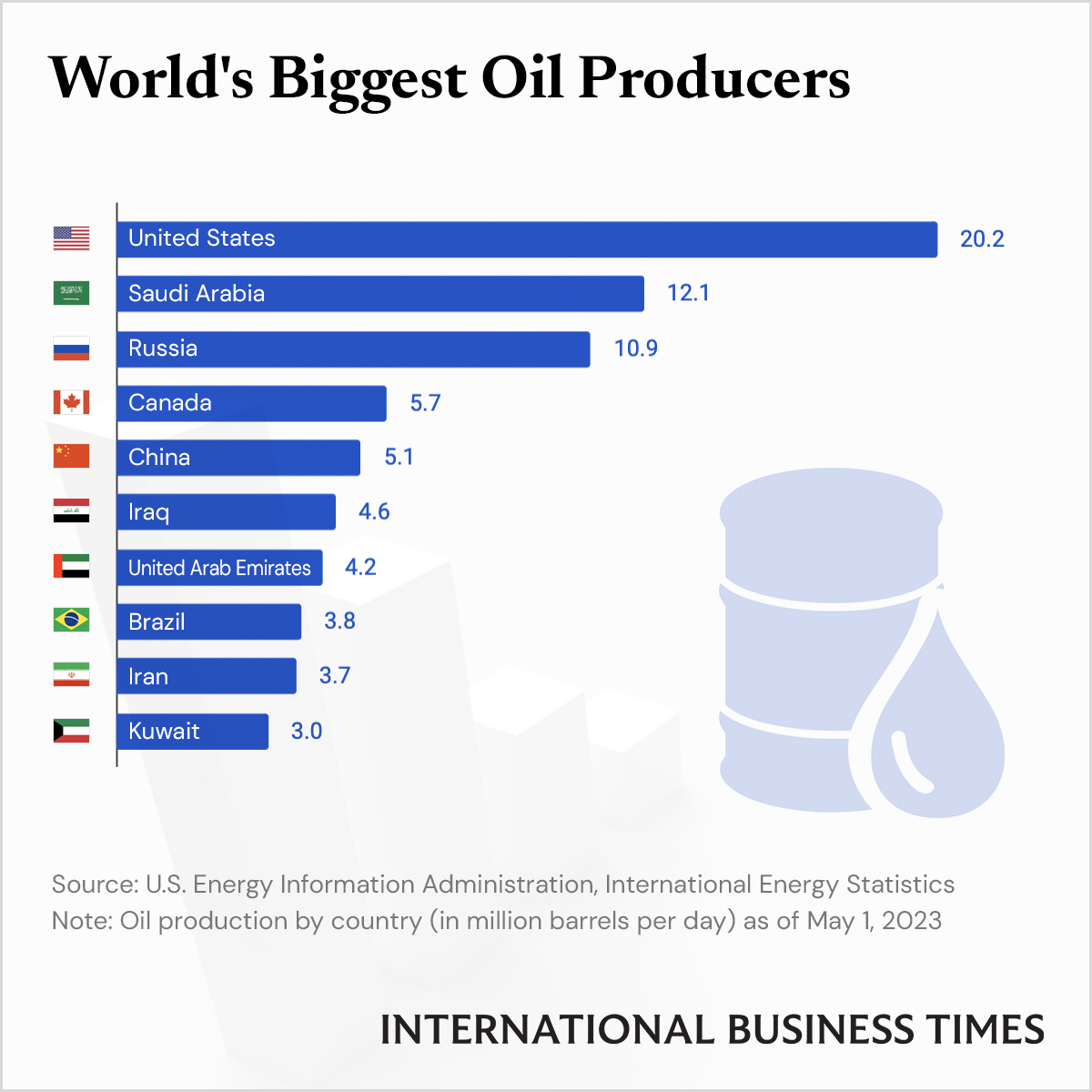

The U.S. is still the largest crude producer in the world (thanks to fracking), but traders/speculators look to "supply and demand" to trigger rises and falls in crude prices (that trickle down to the pricing for refined fuel as gasoline, etc).

BoRaGard

(5,842 posts)multigraincracker

(35,891 posts)mentioned a few weeks ago.

Blackjackdavey

(220 posts)I believe the sole purpose of this bombing is to raise the price of oil in order to make it profitable for companies to exploit the leases in America that they have so far been reluctant to exploit. The goal of bombing Iran is to destroy protected areas in America. We are at war with ourselves.

FredGarvin

(654 posts)Down 12% y-o-y.

I'm surprised it didn't rise a lot more.

BumRushDaShow

(154,990 posts)You shouldn't be because while this is going on, OPEC+ made the decision to increase their production - https://www.democraticunderground.com/10143469225

With that news, it had dropped down below $70/bbl. So this latest set of circumstances sort of "balanced that out" to make the pricing almost status quo (so far).

FredGarvin

(654 posts)This is wild.

BumRushDaShow

(154,990 posts)I guess because I would check it a lot - and mostly for the way they present the spot oil graphs - I decided to go on and sub to MarketWatch.

As of this morning -

The year over year WTI range actually went from a low of $55.12/bbl to a high of $84.52/bbl! Somewhere in the $70s has generally been where it has been bopping around much of the year until OPEC+ made their production increase announcements.

It'll be volatile but I think because of the U.S. dominance, it could have been worse - even with Iran not having taken explicit action to restrict the Strait traffic... at least yet.

FredGarvin

(654 posts)Always will be.

Traders move money around causing prices to increase and decrease.

The pricing of todays oil markets is well within one standard deviation from the average.

CanonRay

(15,377 posts)Up about 50 cents.