Tax Strike Rally Planned Nationwide For Jan 3: 'We Want Our Money Back'

Source: Newsweek

Published Dec 31, 2025 at 07:00 AM EST updated Dec 31, 2025 at 10:05 AM EST

A tax strike rally has been planned in numerous locations around the U.S. on January 3. Posting on X and Facebook, multiple social media users have shared posters and images depicting plans for the day of action in which they will state their intention to withhold taxes.

It is not clear who is organizing the protests but they appear to be aligned with the right, as some social media posts about the protests attack Democrats and say that right-wing politician people associated with the Make America Great Again (MAGA) movement will speak at the events.

Newsweek reached out to the Internal Revenue Service (IRS) by email to comment on this story outside of normal business hours.

Why It Matters

The planned strikes show the extent to which politics is becoming polarized in the U.S. and tensions are escalating. Previous protests have been organized by anti-Trump groups on the left so the emergence of anti-Democrat protests is significant. Meanwhile, if enough people refuse to pay their taxes, this will have a significant impact on the running of key services in different states and could persuade politicians to negotiate with protesters to keep taxpayer-funder operations viable.

Read more: https://www.newsweek.com/tax-strike-rally-protests-us-11287721

Nigrum Cattus

(1,209 posts)they love the idea of less money going into federal

gov., that way they can say "look we don't have any money"

and we need to cut everything !

popsdenver

(1,486 posts)gladly join in the movement to not pay taxes............

Oh wait, they already don't pay much or any taxes, same with Corporations......

How are they able to pay zero taxes??????? Check this out.....legitimate commentary..........

Bayard

(28,473 posts)I had never thought about the difference between income taxes, and wealth taxes. Very good info here.

popsdenver

(1,486 posts)there have been all kinds of laws enacted by the congress members, BOTH Dems and Repubs, to benefit the uber wealthy and Corporations. The biggest ones ever? were done during the Reagan/HWBush years....

kimbutgar

(26,755 posts)OC375

(419 posts)I get some more popcorn, but I predict no sequel to this one.

FredGarvin

(804 posts)Kate Plummer may or may not be a real person.

Looks to be about 20 and is a senior reporter at Newsweek?

Dude, do some due diligence please.

FredGarvin

(804 posts)underpants

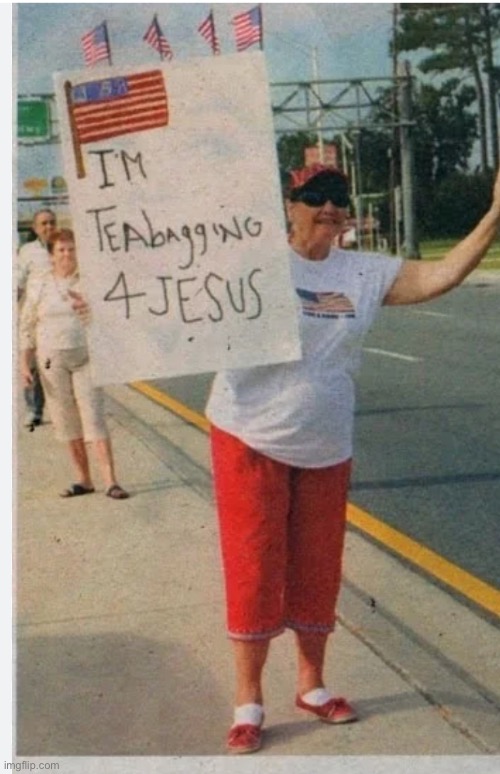

(194,727 posts)Sounds like another teabagger thing.

reACTIONary

(6,969 posts).... have already withheld them for the IRS.

BumRushDaShow

(165,440 posts)regardless of what the employer is paying. I.e., throughout my work career, just to make sure, and since I had no dependents, I set my withholding allowance to "0" (for the max) on my W-4.

As I understand it now, the withholding "allowance" method has changed as of 2020, to be some calculated amount on the W-4. There is also a line for "Exemption from withholding" -

withholding for 2026 if you meet both of the following

conditions: you had no federal income tax liability in 2025 and

you expect to have no federal income tax liability in 2026. You

had no federal income tax liability in 2025 if (1) your total tax on

line 24 on your 2025 Form 1040 or 1040-SR is zero (or less than

the sum of lines 27a, 28, 29, and 30), or (2) you were not

required to file a return because your income was below the

filing threshold for your correct filing status. If you claim

exemption, you will have no income tax withheld from your

paycheck and may owe taxes and penalties when you file your

2026 tax return. To claim exemption from withholding, certify

that you meet both of the conditions by checking the box in the

Exempt from withholding section. Then, complete Steps 1(a),

1(b), and 5. Do not complete any other steps. You will need to

submit a new Form W-4 by February 16, 202

An anti-tax zealot could go ahead and assume they have "no liability" and try to claim that exemption. Alternately, if they would owe after the calc, they could refuse to pay it and risk the penalties. For those on SS (and/or other select retirement pensions) they would need to fill out a form W-4V to determine the withholdings for that and can actually choose not to withhold, and then thumb their noses and ignore the tax due.

I was just looking at the new form W-4V which is very different from earlier versions. I expect that new form came about after passage of the taxcuts for billionaires Brutal Barbaric Bill.

In any case, the IRS has been completely gutted and hollowed out, so how that will impact the tax season is anyone's guess.

reACTIONary

(6,969 posts).... they can't avoid the "payroll" taxes. That's about all a lot of people pay anyway.